We put the value-add into VAT.

VAT is an incredibly complex beast. The rules are ever-changing, compliance is constantly evolving, and if not managed correctly, there’s the risk of fines – or even prosecution. At Gravita, our VAT experts stay up-to-date with the ins-and-outs so you don’t have to. Now that’s a real value-add. If you want more information on our VAT services, please call us on 0207 330 0000 or speak to our VAT Partner, Sandy Cochrane.

100% committed to the 20%

Our sector-wide knowledge is unparalleled. While others shy away from the dreaded 20%, we understand that embracing the complexities of VAT can reap rewards.

Our experts will look to maximise your returns, minimise VAT on sales, and help tackle the impact it has on your cash-flow. They’ll also take care of your VAT returns and help you avoid unnecessary inspections. Plus, if on the rare occasion inspections occur, they’ll also represent you at tribunals so you’re not left to face the music alone.

VAT can be an incredibly complex area. But with proper planning and appropriate record keeping, our specialists can help you take control. It’s why they’ll take the time to get to know you and your business. By understanding how VAT affects you as a company, they can advise you how to take control of it. They know it also has an impact on your cash flow. That’s why they’ll work with you to manage this cash flow impact, provide support to ensure compliance and manage any financial impact.

With them in your corner taking care of your VAT obligations, you’re free to focus on the thing that’s most important to your business; growth.

Ready to get started?

If you’re looking for a new accountant to take charge of VAT for you, or you need more information, our experts are ready and waiting to help you. Plus with experts across multiple tax and finance areas, there’ll always be an expert at hand at Gravita.

To start your journey with us, get in touch below, and one of our tax experts will arrange an introductory consultation.

What VAT services do we offer?

- VAT registration services

- VAT planning and administration

- VAT schemes and how to use the most appropriate scheme for your business

- VAT control and reconciliation

- Completing of VAT returns

- VAT planning to minimise problems with HMRC

- Negotiating with HMRC, dispute resolution and representing you at VAT tribunals

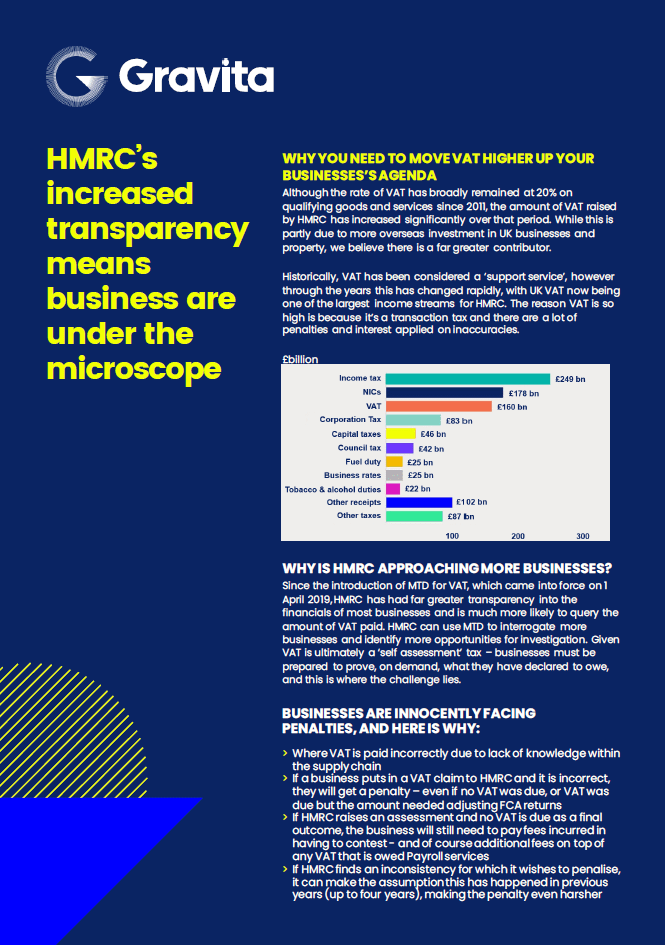

VAT compliance is important, and errors are costly

Gravita has significant experience in assisting our clients with VAT returns (review, preparation, and submission), penalty mitigation, and VAT reviews. A VAT review, especially when coupled with a cash-flow analysis designed to reduce the cost of VAT to the business, can contribute to financial robustness, particularly in the economic headwinds ahead.

For more information about our VAT service, click our document below.

Latest VAT Insights

What’s keeping charities up at night? Economic insights, new accounting policies and VAT planning

Join Katherine Wilkes, Audit Partner, and Sandy Cochrane, VAT Partner, from Gravita as they talk to Will Hobbs, Barclays head of UK Multi Asset Wealth,

The 12 days of Christmas – VAT edition

Written by VAT Partner, Sandy Cochrane Have you ever wondered how VAT comes into play during the 12 days of Christmas carol? We have

Fuel Scale Charge

What is it? The VAT Fuel scale charge is an adjustment that you add to your VAT return to account for the private element of

More services from Tax

“With regular changes to the tax landscape, including complex regimes and greater emphasis on business responsibilities, we’re here to alleviate your stress. We love getting to grips with knotty problems and providing you with useful and practical advice.”

PARMINDER CHATTA

Partner

Let’s work together on your growth journey

We work with forward-thinking businesses and entrepreneurs who are going places. Let us join you on your journey.

What makes us different

01

We have high calibre experts. Our team has years of experience and academic backgrounds meaning you’re dealing with seasoned professionals.

02

We’re tech-enabled, but human-led. There are no robots here, just our talented team who use tech to work more efficiently with you.

03

We look beyond the balance sheet. We don’t just do the job in hand, we’ll actively work with you and offer advice to help you grow.

04

We cover everything in the world of accounting. Ranging from everyday financial worries to complex business challenges.

05

We can grow as you grow. Our service is designed so you can scale our team up or down to suit your needs.

06

We understand time is money. It’s why we provide real-time financial data which can help you capitalise on opportunities, plan better and grow faster.

“The Outsourced Accounting team are truly an extension of my US-based Accounting and Tax Team. The team take great care in our day-to-day operations, which can be quite complex, and they provide our monthly reporting packages on time, every time. The firm’s partners are excellent sounding boards and are quick to respond to our technical accounting and taxation queries. Not only are they true professionals and trusted business partners, but they are also loyal to our family of brands.”

US-based quick service outlet with worldwide reach

“The Gravita team did a superb job moving us over from a 2003 version of Sage to a modern version of Xero. They handled a complex migration with focus and professionalism. Thanks to them and their tech knowledge, our day-to-day finance functions are significantly more efficient. We’re very appreciative!”

YO! Limited

Director