Build and protect your wealth for generations to come

Get strategic tax advice that helps you prioritise your current and future wealth. So whatever we advise today, will help you reap rewards tomorrow.

Our team works hard to reduce the risk of tax investigations, but if you are subject to an enquiry, our team is well placed in helping you out. They’ll help you navigate the world of tax and ensure that you’re fully compliant with all regulations, are meeting your tax obligations and taking advantage of the tax allowances or reliefs you’re entitled to.

At Gravita, we act for many high profile individuals and companies within the media and entertainment sector, including artists, actors, authors, MPs, TV personalities, presenters and musicians.

We always aim to ensure that you only pay tax that you need to.

And because our team of experts use intuitive technology alongside their incredible expertise, they won’t just save you money, they’ll also save you time.

For now and the future

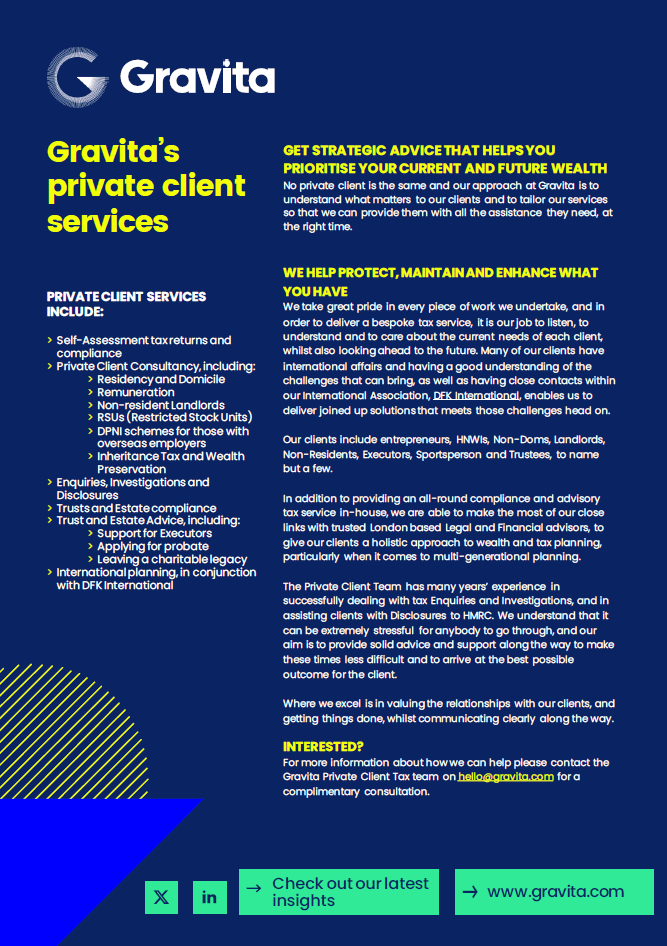

No two people’s financial situations are the same. That’s why every private client we work with is dealt with as an individual. And when it comes to your wealth, you need specialist and personalised advice to help protect, maintain and enhance what you have.

Our specialists can advise you on strategic tax planning across a wide number of areas – while making sure your tax affairs remain compliant. If you have money internationally, they can also advise you with international tax matters and cross border transactions. We offer advice across inheritance tax, CGT, asset structuring, family businesses and investments, trusts and a whole host of other financial considerations.

They’ll start by getting to know you, your lifestyle, and your ambitions. Then help you plan to achieve your goals and wishes.

They’ll also advise you on the best way to protect your wealth for future generations through trust and estate planning. From advising on reducing your taxable assets during your lifetime to planning your will. We work to strategically organise your wealth and ensure your legacy continues for many years.

With us, you’ll get strategic advice and be kept up to date with the latest changes in legislation to ensure you stay tax efficient – saving you valuable time and money in the long term.

Ready to get started?

Our expert team have incredible knowledge across multiple tax and finance areas to ensure you get the best possible service.

To start your journey with us, get in touch below, and one of our experts will arrange an introductory consultation.

- Capital Gains tax

- Inheritance tax

- Income tax

- Media and entertainment

- Self Assessment tax return

- Property tax

- Tax compliance

- Family business advisory

- Asset structuring

- Trusts and estates

- Non-domiciliary tax issues

- Tax investigations

- International tax

- HMRC enquiries

HMRC’s view is that anyone with £10 million or more in assets is considered a high net worth individual.

“At Gravita, we advise on how to strategically organise your wealth and ensure your legacy continues for many years. Your financial situation is one-of-a-kind and we treat you individually to help protect, maintain and enhance what you have.”

– Gary Jackson, Partner

Related Insights

How does salary sacrifice work and what will change from April 2029

Understanding the talk around a UK exit tax before the 2025 Budget

The Chancellor’s proposed changes to partnership tax could have wide implications across professions