What the 2025 Autumn Budget could mean for Income tax and National Insurance

After Rachel Reeves’ speech on 4th November, it will come as no surprise that, we understand, she has spoken to the Office for Budget Responsibility (OBR) about increasing income tax by 2%, potentially to be combined with a drop in National Insurance Contributions (NIC) of 2%.

Before looking at the impact of the changes, the tables below show the current bands for Income Tax and National Insurance in the UK:

Current UK income tax rates

| Income range | Tax rate | Notes |

| £0 – £12,570 | 0% | Personal allowance – income is tax free |

| £12,571 – £50,270 | 20% | Basic rate – 20% on the next £38,000 |

| £50,271 – £100,000 | 40% | Higher rate applies to income over £50,270 |

| £100,001 – £125,140 | ~60% effective | 40% rate plus tapering of the personal allowance (£1 withdrawn for every £2 over £100,000) |

| Over £125,140 | 45% | Additional rate applies once personal allowance fully withdrawn |

Current Employee National Insurance rates

| Type | Income range | Rate / amount |

| Employees – Class 1 NIC | Up to £12,570 | 0% |

| Next £38,000 | 8% | |

| Above that | 2% | |

| Self-employed – Class 2 NIC | Any earning more than £12,570 | £3.45 per week |

| Self-employed – Class 4 NIC | Up to £12,570 | 0% |

| Next £38,000 | 6% | |

| Above that | 2% |

It is understood that the proposals could see the Class 1 Standard Rate dropped to 6%, and potentially the Class 4 rate dropped to 4%, with the 2% rate on higher earnings remaining as it is.

NIC is only paid on earned income at present, not on rental income or investment income, or by those over state pension age.

What would the changes to Income Tax and Employee National Insurance look like in practice?

It will depend on what level of income you have and the source as to what impact this could have. For many below state pension aged individuals whose main source of income is from employment and who earn £50,570 or less, an increase in income tax and an equal reduction in NIC could mean that there is no change to take home pay.

But that would not raise any money, and many other taxpayers will feel the difference – effectively the burden will fall on those with investment or rental income, those over state pension age either in work or receiving a pension, anyone earning above the basic rate threshold and, we assume, anyone who pays themselves by dividend.

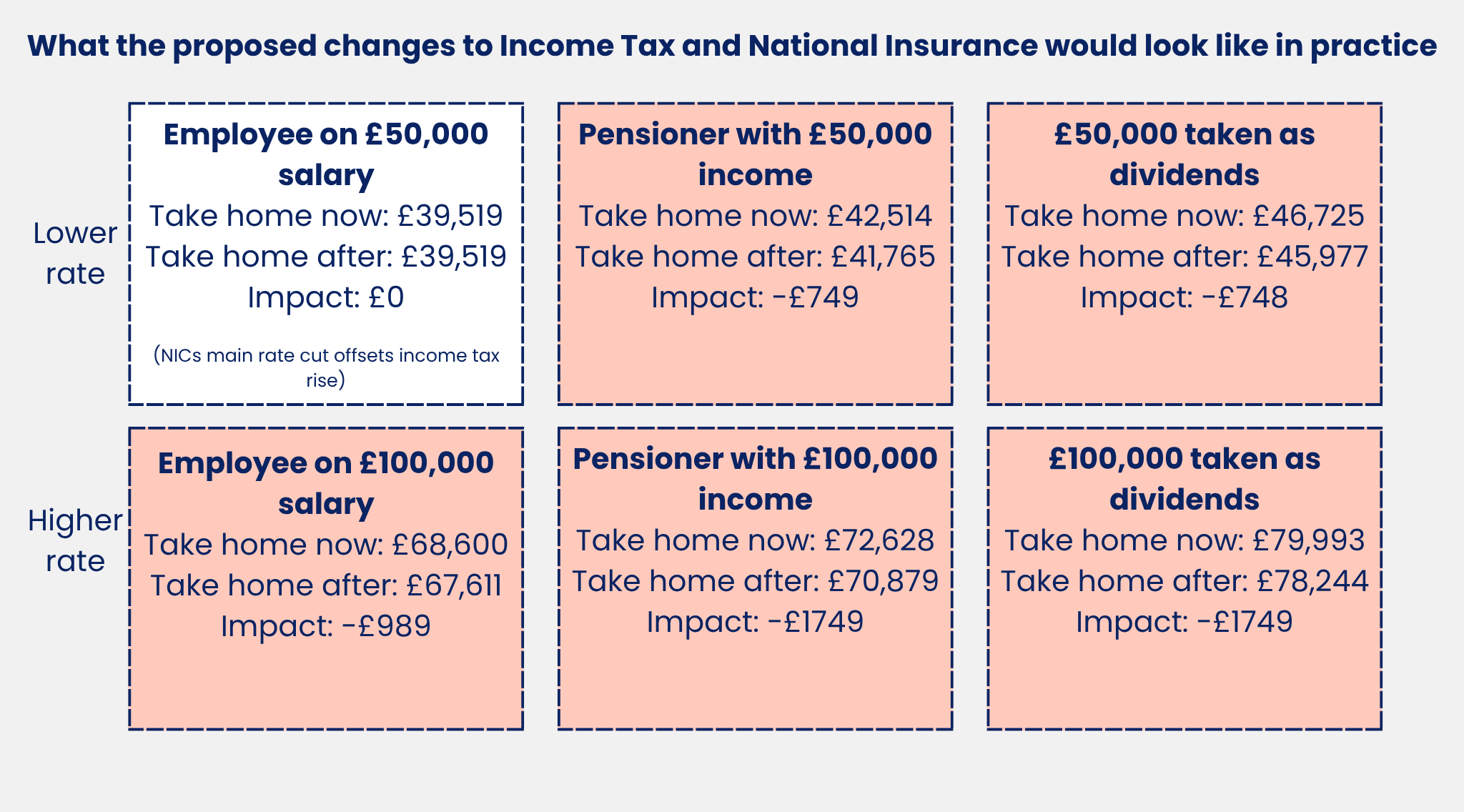

Let us look at a few examples of how this could work:

An employee with £50,000 annual salary currently can currently expect to pay £7,486 income tax and £2,995 NIC, leaving £39,519 take home pay. If a 2% increase is applied to income tax with a 2% reduction in NIC, the take home for the employee is the same: £39,519.

Someone with pension or rental income of the same amount just pays the income tax so takes home £42,514. If income is structured as a dividend, then because of a different rate of tax paid, take home is slightly higher: £46,725. However, where the income is currently NIC free, i.e. from rental, pensions, investments or dividends, take home falls by £749 under the proposed changes: £41,764.

For higher rate taxpayers, employees are impacted too because the reduction in NIC is only likely to apply to the main rate, with the 2% still applying on earnings over £50,570.

If we take the above example for gross income of £100,000, employees are left £989 worse off, and anyone who would not have been paying NIC and who will not benefit from the reduction is £1,749 worse off.

Will it happen?

And that is the £6 billion (we are told) question. It seems a much more practical solution than, say, charging NIC on rental profits, which had been mooted at one point. But this strategy does seem to disproportionately shift the burden onto those of pension age, who will now suffer higher income tax on earned income (if they are still in employment), pensions and investments, and who, as a result of this measure, are likely to feel the pinch the most.

It is possible that there could be a different income tax rate applied to pensions, or higher personal allowances given (harking back to earlier tax regimes) but there has been no suggestion so far.

Can we do anything now?

In all honesty, probably not, although those who can control the timing of their income may wish to consider accelerating it, but we do not know if this is something that could apply immediately, or from next April, or at all….

Join our post-Budget analysis webinar

Making sense of the Autumn Budget 2025

With tax rises widely expected at this year’s Autumn Budget, we will explore the announcements that matter most and how they could affect businesses and individuals across the UK.

In this session, Gravita’s tax experts Thomas Adcock (Tax Partner, London), Ian Timms (Tax Partner, Oxford) and Kelly Fern (Tax Director, Western) will share their insights on the announcements and explore the practical implications for businesses, individuals and advisors alike. You’ll leave with a clear understanding of what’s changed, what it means in real terms, and what actions you might need to consider.

Similar Insights

Why now could be the moment to review your asset plans before the 2025 Autumn Budget

Understanding the talk around a UK exit tax before the 2025 Budget

Budget 2025 predictions: Potential 1% hike in Basic Rate of Income Tax

Sign up to Gravita's latest updates and newsletters

Stay up-to-date with our event invites, latest news and updates, straight from Gravita's experts.