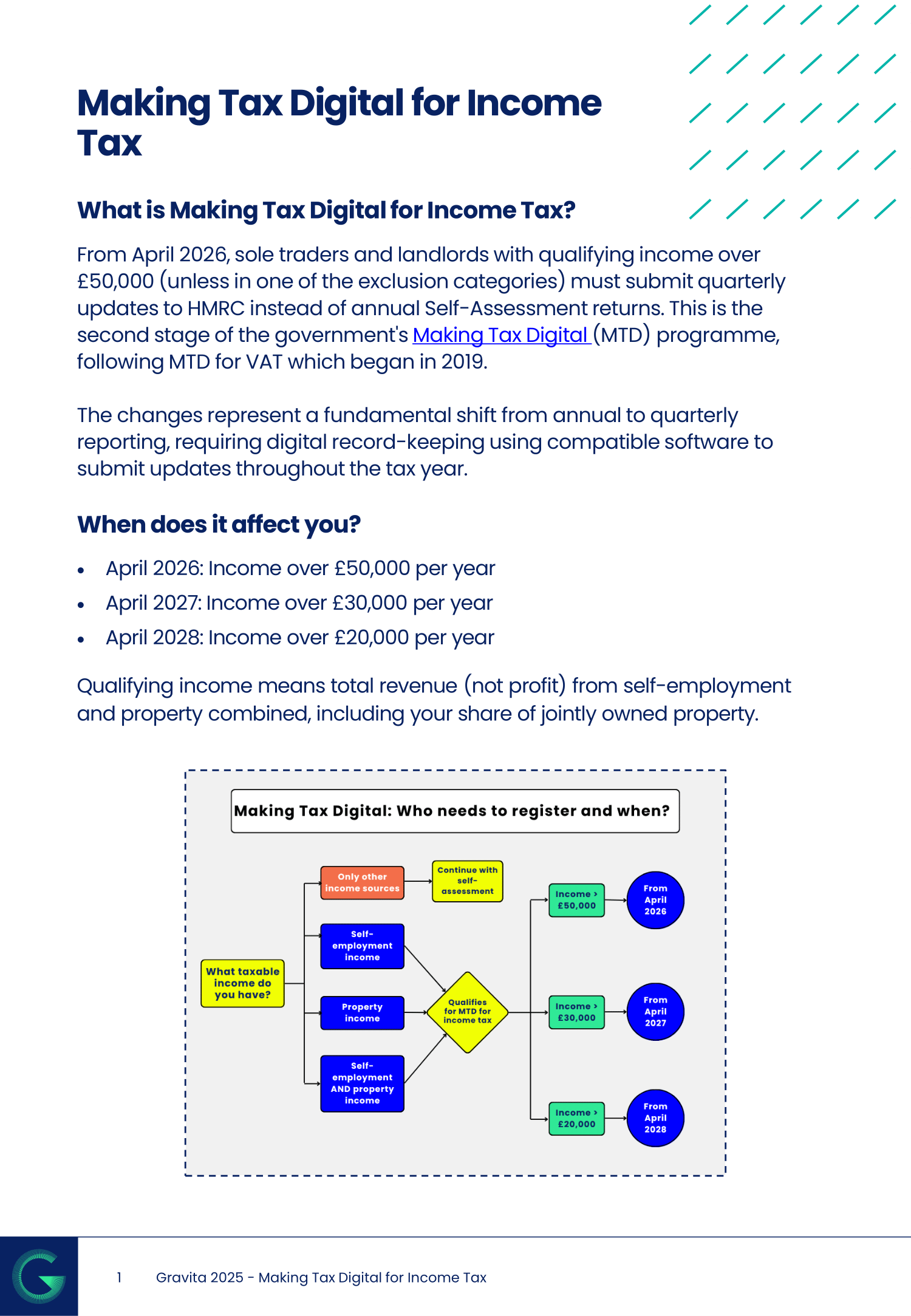

If you’re a sole trader or landlord, the rules around how you report your income tax are changing. From April 2026, Making Tax Digital (MTD) for Income Tax will apply to most individuals with business or property income over £50,000. From April 2027, the threshold drops to £30,000.

It’s a significant shift – but with the right support, it doesn’t have to be overwhelming. This hub brings together our latest insights, FAQs and practical guidance to help you understand what’s changing, what you’ll need to do, and how Gravita can guide you through the process. Whether you’re looking for clarity, reassurance or next steps, you’ll find it here.

Making Tax Digital fact sheet

Stay ahead of the changes with our Making Tax Digital fact sheet. It breaks down everything you need to know about the upcoming requirements for sole traders and landlords, including key implementation dates, registration requirements, and quarterly submission deadlines. Download our fact sheet to ensure you’re fully prepared for these significant changes to UK tax compliance.

Making Tax Digital resources

Clear date

Clear date

Insights

Government announces major increase to agricultural and business property relief thresholds to £2.5 million

What organisations need to know before starting a grant funded project

Hotel La Tour loses at the Supreme Court

Sign up to Gravita's latest updates and newsletters

Stay up-to-date with our event invites, latest news and updates, straight from the Gravita experts.