Implementing your salary sacrifice via your payroll

Written by Payroll Manager, Rebecca Aimey Introduction In today’s competitive job market, employees are increasingly seeking (and often expect) benefits packages to be paid alongside their salary. Employers, on the other hand, are of course keen to retain and attract talent whilst also maximising tax efficiencies where possible. The salary sacrifice options are an effective […]

Is it time to embrace AI to transform your business?

Written by Tech Partner, Ben Chernoff Is it time to embrace AI to transform your business? It’s clear AI is not going away. And while there’s a lot of fear about what AI could do in the wrong hands, it also brings a lot of opportunity for good. It has the potential to drive economic […]

Payrolling of benefits – Feeling the pain of collating your P11D data?

Written by Payroll Manager, Rebecca Aimey Employers who would like to formally payroll benefits for the first time, must register with HMRC. Some seven years ago, HMRC introduced the ability for employers to payroll certain benefits that are classed as a benefit in kind. This has enabled a change in the way employees are taxed […]

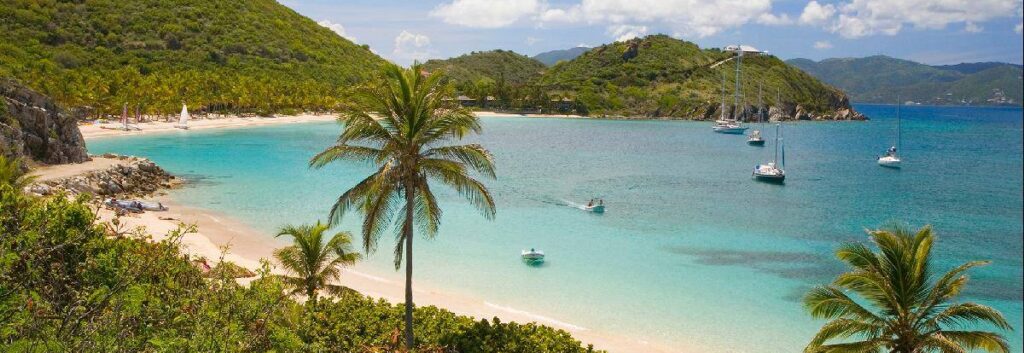

The current outlook for the travel industry

Written by Audit Partner, Luke Metson With the travel industry recovering from the Covid pandemic and travellers facing new challenges, such as high inflation, increasing interest rates and high energy bills, there is a general uncertainty as to their appetite for travel. Whilst the ‘cost-of-living’ crisis is putting pressure on travellers’ finances, many do still […]

Mitigating some risks with SEIS and EIS tax investment schemes

Written by Tax Partner, Toby Hermitage The SEIS (Seed Enterprise Investment Scheme) and EIS (Enterprise Investment Scheme) schemes provide valuable tax incentives for investors who subscribe to shares in particular companies. These reliefs make fundraising for newer and smaller companies much easier as the investor’s downside risk is mitigated and upside benefit is exempt from […]

How technology is transforming professional services firms

In the digital age, technology is reshaping the landscape of industries, and professional services firms are no exception. From automation to data analytics, cloud computing to artificial intelligence, technological advancements are revolutionising the way these firms operate. We explore how technology is transforming professional services firms, enabling them to enhance efficiency, improve client service, and […]

How do you open a UK branch?

Trading with the UK has changed significantly since Brexit came into force, an increasing number of overseas businesses are opening offices in the UK. If you are considering establishing your business in the UK to make trade easier, here is an outline of some of the benefits, tax law considerations, and how to start the […]

How to maximise Inheritance Tax relief with hybrid business activity

Written by Tax Partner, Parminder Chattha Inheritance Tax (IHT) is chargeable on the value of an estate when someone dies, although it could also be chargeable on certain lifetime transfers, as well on property held within a relevant property trust. The rate of tax is 40% above a certain exempt amount, and there are various […]

Spring Budget report 2023

Download report Jeremy Hunt announced his second fiscal statement and first Budget since becoming Chancellor against a backdrop of fragile public finances, an ongoing cost of living crisis, and increased Government borrowing. Ahead of time, we expected the Chancellor’s speech – dubbed the ‘back to work Budget’ by the media – to focus on […]

Jeremy Hunt’s Spring Budget 2023: The four E’s

Jeremy Hunt announced his Spring 2023 Budget today, once again returning to his familiar four pillars of growth: Enterprise, Employment, Education, Everywhere. Below are a few of the announcements in today’s Budget Statement, we will add more in our full budget report tomorrow morning which can be downloaded on our website. Energy Government energy […]